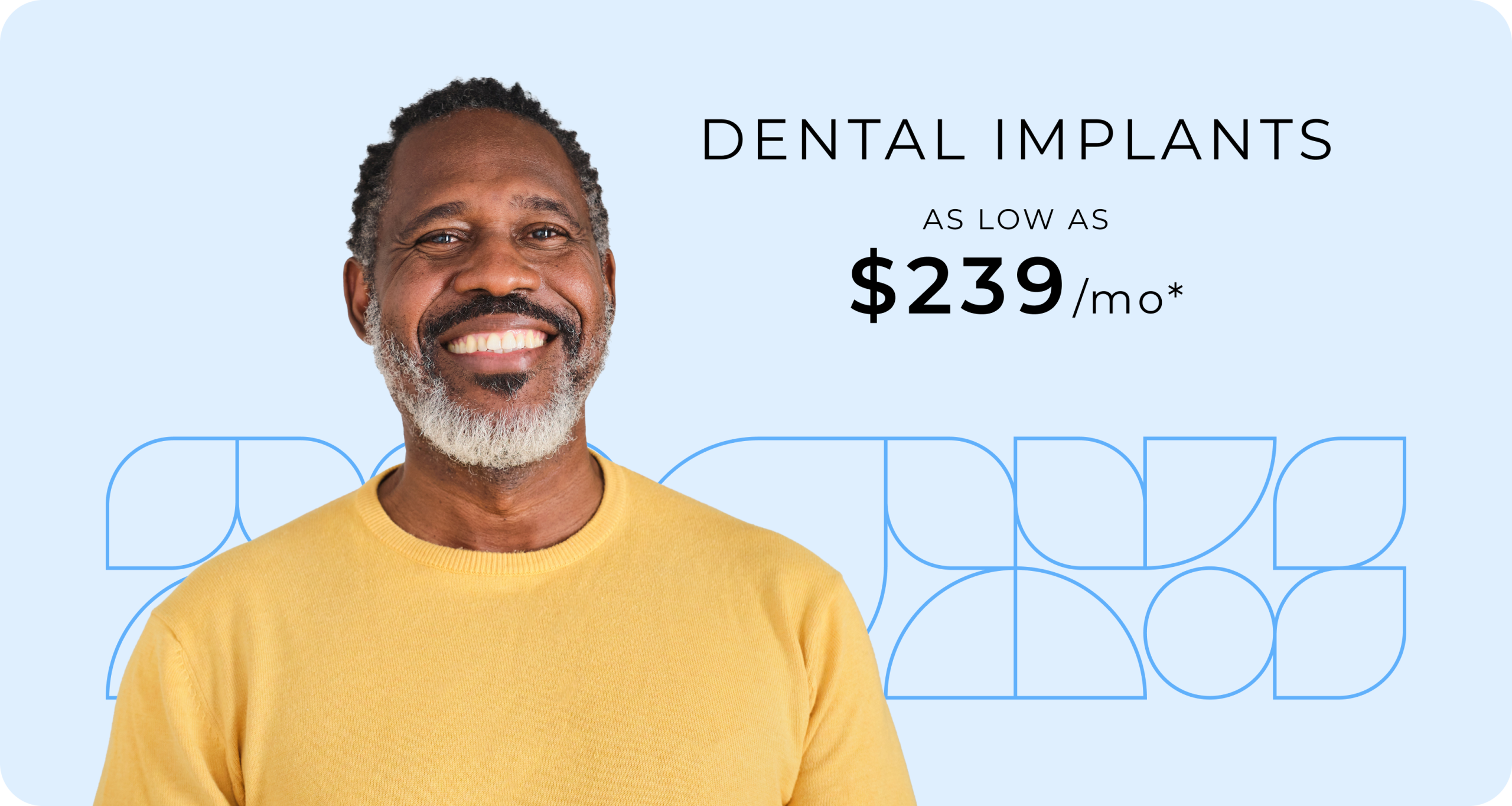

Break cost barriers with friendly monthly plans. See how it works.

“PatientFi is easy to use for both the patient and the practice. In just three months, our acceptance rates have increased by 75%.”

TISHA F, PRACTICE

“PatientFi’s value proposition makes our practice an even bigger success by decreasing financing risks for patients and lowering costs for us.”

JANELLE R. PRACTICE

“Working with PatientFi has made it a breeze to add patients and help them with easy payments. So far, it’s been the best tool—even for those with low credit scores!”

KAYLA J, PRACTICE

“PatientFi allows patients to get the procedures they want or have been wanting for a very long time—without the cost barrier. Patients often withhold from certain procedures because they know they’re not in a position to pay a large amount upfront, and PatientFi completely solves that.”

MADELINE T, PRACTICE

“PatientFi’s unique offering benefits both patients and our practice, increasing our practice’s revenue while also providing affordable plans for our patients with no hard credit check.”

CHRISTOPHER G., MD, FACS, PRACTICE

UNLOCK SPENDING POWER FOR

More Patients

Highest approval rates and amounts

Funding up to $60,000

60 second application, instant approvals

Zero interest* plans for all patients

Better offers, flexible for any budget

Best pricing in the industry, guaranteed

The #1 Choice

for top practices

Exceptional service, no exceptions. Read reviews from real patients and providers.

Ready to get started?

Featured In

Breaking Healthcare

Cost Barriers

Sell smarter with monthly pricing so it’s easy for patients to say yes.

We equip your staff with the tools and confidence to make the most of financing as a conversion tool.